Overtime tax rate calculator

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. SmartAssets Texas paycheck calculator shows your hourly and salary income after federal state and local taxes.

How To Calculate Gross Income Per Month

Tax you will pay PAYE Pay As You Earn for your age group and income bracket.

. Thats where our paycheck calculator. With average income tax rates and low property taxes Louisiana may be on your list of potential places to call home. Federal income tax rates range from 10 up to a top marginal rate of 37.

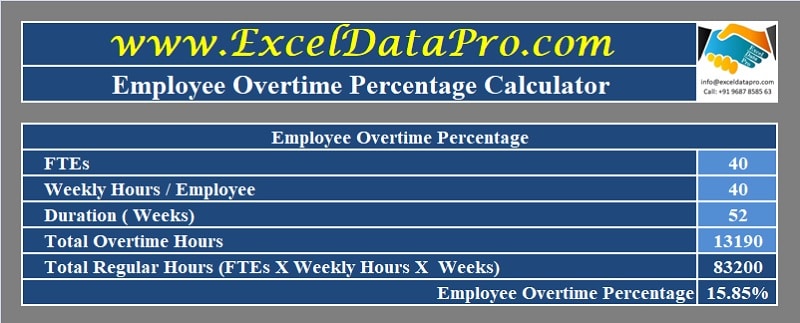

Multiply your monthly salary. The algorithm behind this overtime calculator is based on these formulas. The basic overtime formula is Hourly Rate Overtime Multiplier Number of Overtime Hours worked in a particular week.

If you do any overtime enter the number of hours you do. Ohio has a progressive income tax system with six tax brackets. In fact overtime is taxed as the same rate as ordinary pay.

This calculator can determine overtime wages as well as calculate the total earnings. If you are paid a salary based on a 40-hour workweek your regular rate is determined as follows. Taxable income for the year.

Then enter the hours you. 30 x 15 45 overtime. 1200 40 hours 30 regular rate of pay.

See where that hard-earned money goes - with UK income tax National. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. See the Calculator Tools your competitors are already using - Start Now.

You cant withhold more than your. When an employer pays overtime to any employee that is not more than 50 of the employees monthly basic salary the employer will deduct 5 as overtime tax. Use this calculator to help you determine your paycheck for hourly wages.

Overtime Hourly Wage. For all filers the lowest bracket applies to income up to 25000 and the highest bracket only. Overtime Hours per pay period Dismiss.

All hours that exceed 40 in a workweek must be paid at an overtime rate of time-and-a-half. Ad GetApp has the Tools you need to stay ahead of the competition. The employees total pay due including the overtime premium for the workweek can be calculated as follows.

You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in Texas. Overtime Hours per pay period. See where that hard-earned money goes - Federal Income Tax Social Security and.

However this can be slightly more complicated where your overtime isnt paid at the same rate as your ordinary hours. The maximum an employee will pay in 2022 is 911400. If you make 1800 per hour your overtime rate is 2700 per hour.

First enter your current payroll information and deductions. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. In case someone works in a week a number of 40 regular hours at a pay rate of 10hour plus an 15 overtime hours paid as double time the following figures will result.

The overtime calculator uses the following formulae. Rates range from 0 to 399. Taxable income R 19980000 - R 000 - R 000.

However if the overtime.

Overtime Calculator

3 Ways To Calculate Your Hourly Rate Wikihow

Overtime Pay Calculators

After Tax Uk Salary Tax Calculator

Salary Overtime Calculator Calculate Time And A Half Double Time Wages

Hourly Paycheck Calculator Step By Step With Examples

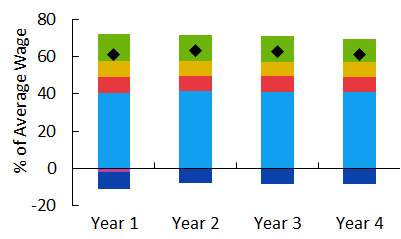

Tax Benefit Web Calculator Oecd

Income Tax Cuts Calculator Australia Federal Budget 2020 21

Overtime Pay Calculators

Download Overtime Percentage Calculator Excel Template Exceldatapro

The Certified Payroll Professional Corner Regular Rate Calculation For Overtime Purposes

What Is Annual Income How To Calculate Your Salary Income Income Tax Return Salary Calculator

Overtime Calculator How To Calculate Overtime Pay Breathe

The Salary Calculator Election Comparison Calculator

Calculate Take Home Pay

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Overtime Calculator